Gold: $4,533.58 ▲ $53.99 Silver: $79.29 ▲ $7.44 Platinum: $2,492.24 ▲ $232.83 Palladium: $2,004.33 ▲ $243.01

In 1971, President Richard Nixon made a decision that would forever change the global financial landscape: he ended the gold standard, severing the direct convertibility of U.S. dollars to gold. This watershed moment marked the beginning of a fascinating economic experiment – a world where fiat currency would reign supreme. Yet, over the five decades since this momentous shift, gold has consistently demonstrated its enduring value, often outperforming the very currency that once derived its worth from this precious metal.

Prior to 1971, the Bretton Woods system maintained global monetary stability by fixing the U.S. dollar to gold at $35 per ounce. Other currencies were then pegged to the dollar, creating a pseudo-gold standard for the entire world. When Nixon closed the gold window, it unleashed a new era of floating exchange rates and opened the door to unprecedented monetary policy flexibility – but also to currency devaluation.

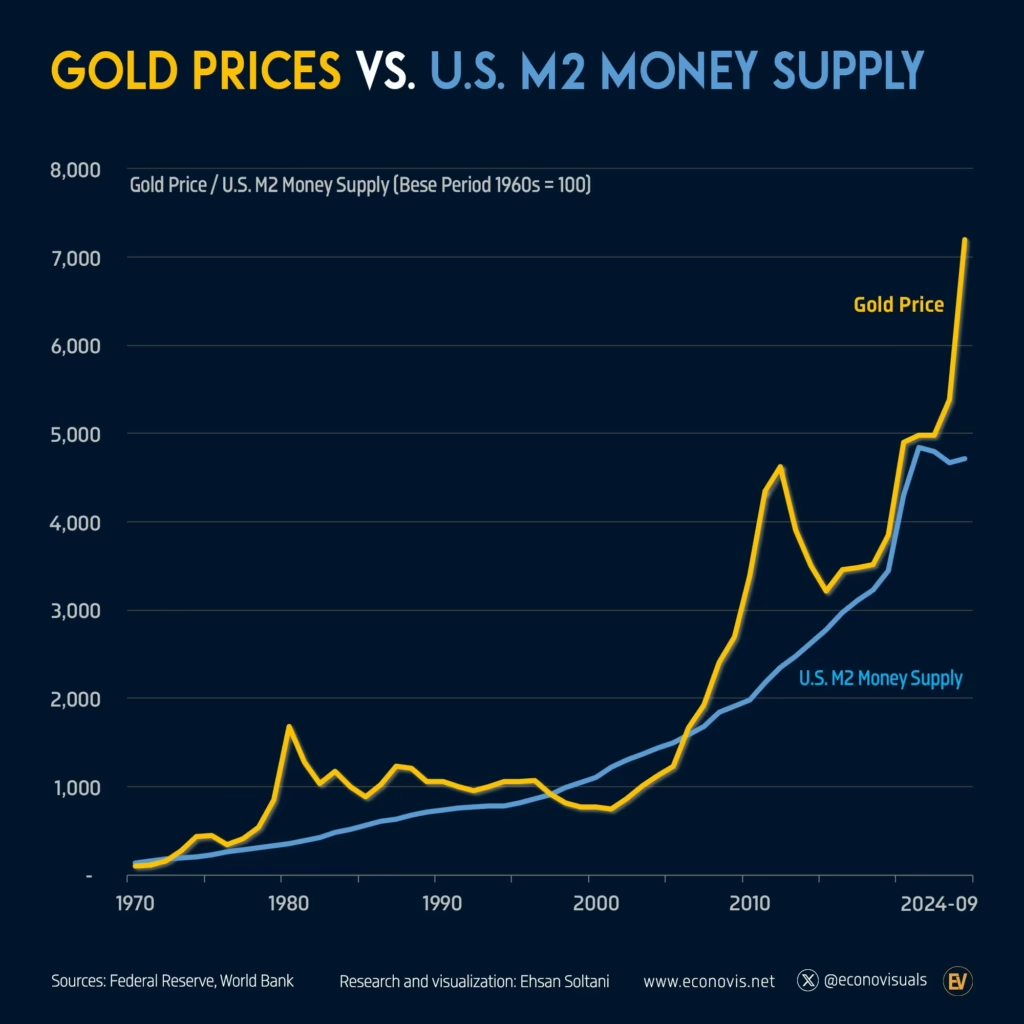

The statistics paint a compelling picture of gold’s performance versus the dollar since 1971. When the gold standard ended, gold traded at $35 per ounce. By 2024, gold has reached over $2,000 per ounce – representing a staggering increase of more than 5,700%. Meanwhile, the purchasing power of the dollar has steadily eroded, with $1 in 1971 being worth less than 15 cents in today’s money when adjusted for inflation.

The 1970s proved to be a remarkable decade for gold, as the metal surged from $35 to over $850 per ounce by January 1980. This period was characterized by:

During this time, gold served as a crucial hedge against inflation and currency devaluation, delivering returns that far outpaced traditional investments and preserving wealth for those who held it.

While gold’s price retreated from its 1980 peak and remained relatively stable through the 1980s and 1990s, it still maintained significant gains over its 1971 price. During this period, the dollar experienced:

Even during this relatively quiet period for gold, it continued to serve as a store of value, maintaining purchasing power while the dollar’s buying power steadily declined.

The new millennium ushered in another spectacular bull run for gold, driven by:

From 2000 to 2011, gold prices rose from around $300 to over $1,900 per ounce, once again demonstrating its role as a safe haven during times of economic turbulence.

In recent years, gold has faced competition from new asset classes like cryptocurrencies, yet it has maintained its status as a premier store of value. Several factors continue to support gold’s performance:

Central banks worldwide have engaged in unprecedented monetary expansion, particularly since the 2008 financial crisis and the 2020 COVID-19 pandemic. This has led to:

Global tensions and economic challenges have reinforced gold’s role as a safe-haven asset:

Many central banks, particularly in emerging markets, have significantly increased their gold reserves, recognizing the metal’s importance in a diversified national portfolio.

Several fundamental factors explain gold’s sustained outperformance against the dollar:

Unlike fiat currencies, which can be created at will by central banks, gold’s supply is naturally limited. Annual mining production adds only about 1-2% to the existing gold stock, creating a natural constraint on supply growth.

Gold’s value is recognized across cultures and throughout history, making it a truly global asset that transcends national boundaries and political systems.

Physical gold ownership represents one of the few assets that carry no counterparty risk, an increasingly valuable characteristic in a world of complex financial instruments and interconnected risks.

Gold has consistently proven its worth as an inflation hedge, maintaining purchasing power over long periods while fiat currencies steadily lose value.

As we look to the future, several factors suggest gold’s outperformance versus the dollar may continue:

Government debt levels have reached historic highs, potentially threatening currency stability and increasing the appeal of hard assets like gold.

The unprecedented scale of monetary intervention by central banks raises questions about long-term currency stability and inflation risks.

Advancing technology continues to find new industrial applications for gold, potentially supporting demand beyond its monetary and jewelry uses.

The five decades since the end of the gold standard have demonstrated gold’s enduring value as a store of wealth and hedge against currency devaluation. While the dollar remains the world’s reserve currency, its purchasing power has steadily eroded through inflation and monetary expansion. Gold, in contrast, has maintained and increased its value, providing a reliable store of wealth across generations.

For investors and savers concerned about preserving their purchasing power over the long term, gold’s track record since 1971 offers compelling evidence of its effectiveness. While past performance doesn’t guarantee future results, the fundamental factors that have driven gold’s outperformance – limited supply, universal recognition, and independence from monetary policy – remain firmly in place. Many investors utilize precious metals in their IRA for diversification. Find out more here!

As we navigate an increasingly complex and uncertain financial landscape, gold’s role as a portfolio diversifier and wealth preserver appears more relevant than ever. The lesson of the past fifty years is clear: while currencies may come and go, gold’s value endures, making it an essential consideration for long-term wealth preservation strategies.